Experts urge tax reform in real estate to boost homeownership

Notwithstanding the numerous challenges impeding housing sector growth and access to homes by Nigerians, a major issue is the multiplicity of taxes, which affects developers and building materials producers in end-products delivery. Experts say industry tax reform and interventions will improve homeownership. Victor Gbonegun writes.

Governments at federal and state levels have been urged to review existing taxes in the real estate sector as part of ongoing tax reforms to deepen housing accessibility across the country.

The operatives also demanded interventions for building materials manufacturers and property developers to increase homeownership rate.Property tax has over the years remained a vital source of revenue for the government across all levels. Essentially, such taxes are imposed on homeowners based on their worth.

In most cases, the board of internal revenue is charged with the role of tax administration in the states such as Lagos, Kano, Enugu State, Ondo, Bauchi, Abuja, and Borno States, among others.

The tax policy rates range between 0.14 and three per cent of the property’s assessed value in states, while the local governments also collect tax for public services such as roads, schools, hospitals, and more. Property owners are expected to pay property tax yearly or risk fines and penalties for default.

But the duplication of taxes, the valuation methods, discriminatory rates and inclusion of ground rent have become a burden to operators in the real estate sector, making Nigeria’s homeownership rate to be behind nations like the United States of America with homeownership rate of over 60 per cent.

In Africa, South Africa boasts of a homeownership rate of 67.7 per cent, Benin Republic, with homeownership level of 61 per cent and in Kenya, the homeownership rates hover around 73 per cent, while Nigeria stood at about 20 per cent.

The nation’s real estate industry has also been heavily impacted by economic instability and inflation. Inflation rate in Nigeria increased to 26.72 per cent in September from 25.80 per cent in August of 2023.

The Guardian learnt that real estate tax is based on the property’s assessed value, on the chargeable properties, including land, buildings, and improvements on fences or landscaping.

Taxes are charged on residential property, commercial property, land, specific improvements to land such as retaining walls and fencing, any mineral rights associated with the property, and any fixtures or equipment affixed to the property, as well as intangible property, such as a business’s leasehold improvements.

Specifically, the taxes in real estate sector come under the following names: ad valorem property tax, stamp duty tax, Capital Gains Tax (CGT) on property, personal income tax on property, tenement rates, Land Use Tax (LUT), value-added tax on property, and others.

Already, the Federal Government has shown commitment towards tax reform with the setting up of the Presidential Fiscal Policy and Tax Reform Committee, which has come up with key recommendations that include measures to address duplication of functions in public service.

To ensure prudent public financial management and optimise value from government assets and natural resources, the committee has suggested the use of technology “Data4Tax” to expand the tax net, increase personal income tax exempt threshold and personal relief allowance, tax break for private sector in respect of wage increases to low-income earners, transport subsidy and net increase in employment and payment of taxes on foreign currency denominated transactions in Naira for Nigerian businesses.

Others include suspension of multiple taxes, which place burdens on the poor and small businesses and compensate with windfall revenue of certain agencies.

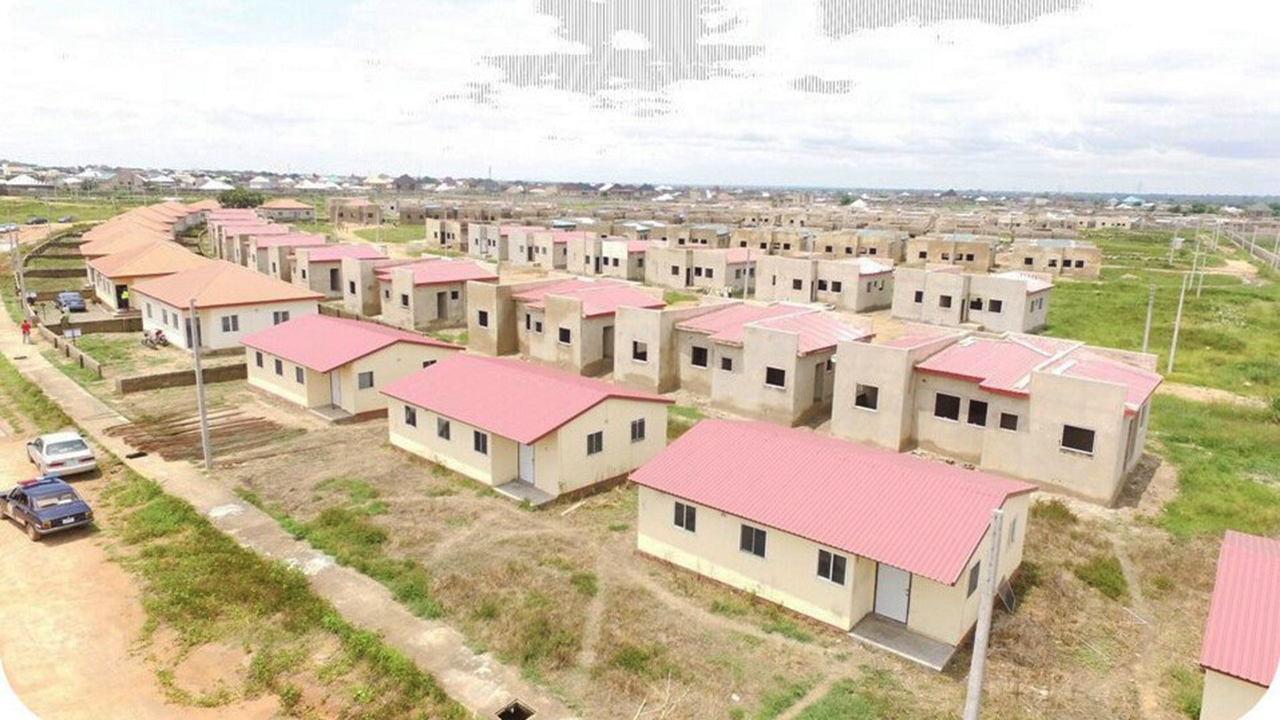

However, experts are advocating industry specific intervention to increase activities in the real estate sector and reduce the estimated 28 million housing deficits in the country.

A Professor of Estate Management at the University of Lagos, Austin Otegbulu, said critical tax reforms are needed in the real estate industry such as tax holidays to enable developers to provide cheaper and affordable housing for Nigerians.

Otegbulu, who doubles as an estate surveyor and valuer, observed that besides the existing multiplicity of taxes in the sector, the rates are high and serve as a burden to players in the industry.

“A developer, who has gone to borrow money from the bank will need to pay about 28 per cent interest rate and authorities will want to tax the developer for about 30 per cent tax.

“That means the whole money he borrowed is gone. In other climes, the developer would not pay tax until he or she finishes paying the loan on the housing project. One will discover that by the time tax is added to the cost of loan, the developer may not break even.”

He said through tax holidays, a developer can be given a moratorium of up to five years to stabilise after borrowing from banks before he starts to pay tax. This type of policy, he said, should be implemented and extended to different types of housing developments.

“In some states, when you want to buy property you are asked to register it. Government will say the person should pay a special tax. For instance, my father gave me a plot of land somewhere, by the time the land was given to me in 2004; it may be worth N40 million but let’s say now the land is worth N200 million.

“If l sell the land at that rate and use the money to buy property in another place that is worth N180 million, the government will now assess me as the very rich even though I have been paying income tax, they will ask me to pay another special income tax. When you exchange property with another, you are expected to pay tax on that property and at the same time on your income.

“If you tax people based on their income, how will they have enough money to pay for their rents, when the money at hand has lost so much value. For instance, a professor in the university earns below $400 per month and there is nowhere in the world where a professor earns such a meager amount and you will still want him/her to pay tax.”

He said there should be incentives and tax rebates for producers of building materials. According to him, when there are too many taxes on building materials manufacturers, they will pass the taxes to the customers and property developers.

“High taxes affect the cost of production, as the manufacturer includes the tax on the cost of selling the product, otherwise he will run at a loss. A lot of businesses have closed down due to multiple taxes.

“The LUT in Lagos, the residents don’t reap the benefits because the roads are still bad, no water in many places and people dig boreholes or buy water. Government must ensure that there is value for taxes collected from taxpayers. People pay the tenement rate, but they are not seeing the effects on property or environment where they live,” he said.

Immediate past president, Association of Town Planning Consultants of Nigeria (ATOPCON) Mr. Muyiwa Adelu, said tax reform is urgently needed to curb current increase in prices of building materials.

He said the cost has gone beyond the reach of many and is impacting the cost of housing. “If the Federal government comes up with tax reform for the building materials’ manufacturers, the cost of materials will reduce and it will be easier for the housing industry to grow,” he said.

He expressed worries over some states that use the housing sector to collect taxes, describing it as unacceptable. He said: “Government cannot be billing people’s houses because they want to collect personal income tax. If l wants to develop a house, it can take 20 years to complete it, it is the obligation of the owner to pay tax and not for the government to impose tax on the building.

“Government should stop using its physical planning ministries to collect taxes. That is why we have slums in the country because once you ask people to pay so much, they will abandon the buildings. ”

Adelu highlighted other reforms needed to include working on the mortgage system by making it effective for developers and Nigerians to have access to homes.

He said: “Today N15 million can barely buy a good house. Government needs to put action into its voice. FMBN should do more than they are doing now. We have over 20 million people that need houses. The government needs to boost the real estate industry.”